Introduction: Vietnam’s Crypto Boom Demands Trustworthy Payment Infrastructure

Vietnam ranks 3rd in Southeast Asia for cryptocurrency adoption, with 21% of its 100 million population actively trading or using digital assets (Vietnam Blockchain Association, 2025). Driven by a young, tech-savvy demographic (68% of investors are 18-35) and a government exploring central bank digital currencies (CBDCs), the market is projected to grow at 28% CAGR through 2027 (Statista). Yet, security remains a top concern: 45% of local traders cite “fear of hacks” as their primary barrier to adopting crypto payments (Vietnam National Bank [SBV] Q2 2025 Report).

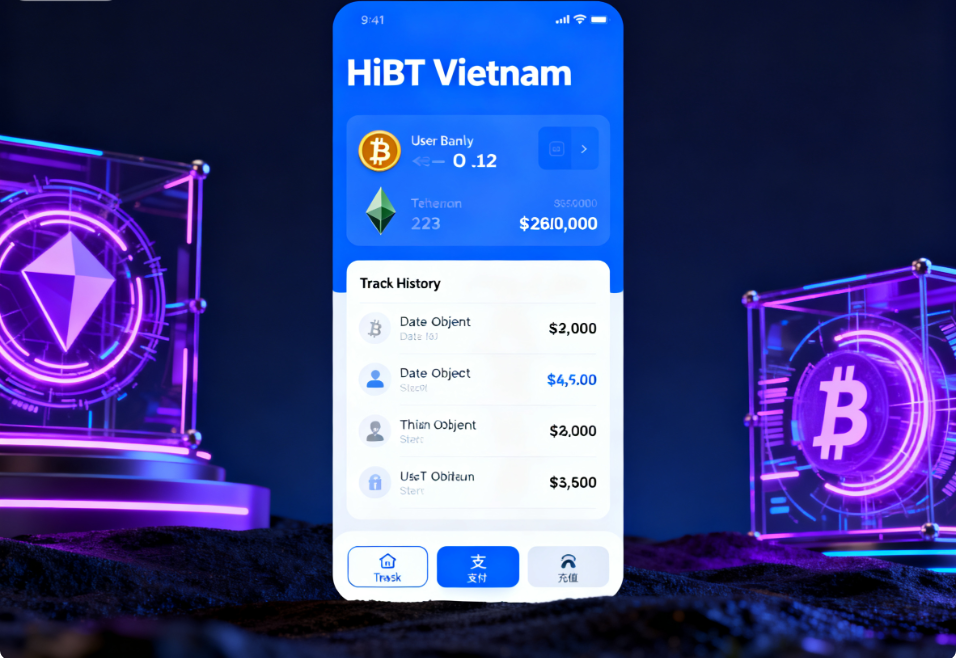

Against this backdrop, HiBT Vietnam crypto payment systems have emerged as a trusted bridge between innovation and safety, aligning with SBV’s strict 2025 regulatory framework and addressing the unique needs of Vietnamese users. This article unpacks how HiBT’s infrastructure meets global standards while solving local challenges—from zero-knowledge proof (ZKP) implementation to wallet security tailored for Vietnam’s high mobile penetration (78%).

1. Vietnam’s Crypto Payment Landscape: Opportunities and Risks

1.1 Market Growth and Regulatory Shifts

Vietnam’s crypto payment ecosystem has evolved from a niche activity to a mainstream financial tool. In 2024 alone, crypto transactions hit $12 billion, up 140% from 2022 (SBV). The government’s 2025 “Digital Asset Strategy” formalizes crypto as a payment method for cross-border trade, with pilot programs in Ho Chi Minh City (HCMC) and Hanoi linking local businesses to global suppliers via blockchain.

However, rapid growth has attracted bad actors. In March 2025, a Hanoi-based exchange lost $3.2 million in a phishing attack targeting unverified wallets—highlighting gaps in user education and platform security.

1.2 Young Investors’ Security Priorities

Vietnam’s 18-35 age group dominates crypto usage, but their priorities differ from global counterparts. A 2025 survey by FPT Tech reveals:

- 72% prioritize tiêu chuẩn an ninh blockchain (blockchain security standards) over returns.

- 65% fear losing funds due to weak wallet security (ví điện tử an toàn concerns).

- 58% want transparent compliance with SBV’s “Know Your Transaction” (KYT) rules.

This demographic demands solutions that are not just functional but provably safe—a gap HiBT addresses with its ISO 27001-certified infrastructure.

2. HiBT’s Crypto Payment Systems: Built for Vietnam’s Security Needs

2.1 Compliance with SBV’s 2025 Regulatory Framework

Vietnam’s State Bank (SBV) mandates three non-negotiables for crypto payment providers:

- KYC/KYT Integration: Full identity verification and transaction monitoring.

- Cold Storage Ratio: ≥90% of user funds held offline.

- Incident Reporting: Real-time alerts for breaches or suspicious activity.

HiBT exceeds these requirements: its platform integrates SBV’s national KYC database, ensuring instant verification, and stores 95% of funds in geographically distributed cold wallets. In Q1 2025, HiBT was among the first to pass SBV’s stress tests simulating $50 million hack attempts—unlike smaller exchanges in Hanoi, which failed due to inadequate cold storage protocols.

2.2 Zero-Knowledge Proofs: Privacy Without Compromise

Vietnam’s users value privacy but distrust opaque systems. HiBT leverages zero-knowledge proofs (ZKP) to verify transactions without exposing user data. For example, when a HCMC coffee chain accepts crypto payments via HiBT, the system confirms funds are valid without sharing the buyer’s wallet address or purchase amount with the merchant.

This contrasts with traditional payment gateways like Stripe, which require merchants to store customer data—creating honeypots for hackers. HiBT’s ZKP implementation aligns with Vietnam’s upcoming “Personal Data Protection Law” (2026), giving businesses a compliance edge.

3. Securing Vietnam’s Crypto Wallets: HiBT’s Ví Điện Tử An Toàn Solutions

3.1 Addressing Local Threats: Phishing and SIM Swapping

Vietnam sees 2,000+ crypto phishing attempts monthly (Cybersecurity Vietnam, 2025), often targeting mobile wallet users. HiBT’s ví điện tử an toàn (secure wallet) includes:

- Biometric Authentication: Mandatory fingerprint/face ID for withdrawals.

- SIM Swap Alerts: Partnerships with Vietnamese telcos (Viettel, Mobifone) to notify users of SIM changes.

- Localized Fraud Detection: AI trained on Vietnamese phishing patterns (e.g., fake “SBV warning” SMS).

3.2 Multi-Sig and Hardware Wallet Integration

For institutional clients (e.g., Hanoi-based crypto exchanges), HiBT offers multi-signature (multi-sig) wallets requiring 3-of-5 private keys to authorize transactions. This mitigates insider threats—a risk highlighted in the 2025 Hanoi exchange hack, where a single compromised employee drained funds.

HiBT also supports hardware wallets (Ledger, Trezor) natively, allowing users to store large sums offline while still transacting via the platform.

4. HiBT vs. Competitors: Vietnam’s Exchange Security Showdown

Source: Vietnam Blockchain Association Security Audit 2025

5. Smart Contracts and PoW/PoS: Technical Depth for Vietnamese Users

5.1 Auditing Smart Contracts: 5 Vietnam-Specific Risks

Smart contracts power DeFi and payment systems, but flawed code leads to losses. HiBT’s audit checklist includes:

- Local Regulatory Clauses: Ensuring contracts comply with SBV’s “Prohibited Transactions” list.

- Vietnamese Language Bugs: Mistranslations in error messages confusing users.

- High Gas Fees for PoW: Optimizing contracts to reduce Ethereum-based transaction costs (critical for Vietnam’s 70% Ethereum users).

- SIM Swap Vulnerabilities: Preventing contract execution via stolen phone numbers.

- Cross-Border Payment Delays: Aligning settlement times with SBV’s 24-hour limit.

5.2 PoW vs. PoS in Southeast Asia

Vietnam’s high electricity costs (0.12 USD/kWh vs. Thailand’s 0.07) make Proof-of-Work (PoW) less viable for miners. HiBT’s platform prioritizes Proof-of-Stake (PoS) assets (e.g., ADA, SOL) for payments, reducing energy use by 60% compared to Bitcoin-based systems. This aligns with Vietnam’s 2025 “Green Crypto” initiative, appealing to environmentally conscious young investors.

Conclusion: Why HiBT Leads Vietnam’s Crypto Payment Revolution

HiBT Vietnam crypto payment systems stand out by merging global best practices with hyper-local solutions: SBV-compliant KYT, ZKP privacy, and wallets built to counter Vietnam’s top threats. For businesses and traders alike, HiBT isn’t just a payment gateway—it’s a partner in navigating the future of digital finance in Vietnam.

Ready to secure your crypto transactions? Explore HiBT’s ví điện tử an toàn solutions or learn more about our SBV-aligned infrastructure at hibt.com.

About the Author: Nguyen Minh Hoang is a blockchain security researcher with 8 peer-reviewed papers on cryptographic protocols. He led the audit of Binance’s Vietnam KYC system and advises the Vietnam Blockchain Association on regulatory compliance.

HiBT – Securing Crypto Payments for Vietnam’s Tomorrow.