The blockchain universe is expanding at a breathtaking pace. While Bitcoin introduced decentralized digital money and Ethereum pioneered smart contracts, the next evolution is focused on solving a critical challenge: creating a scalable, interconnected ecosystem of blockchains. This is the ambitious vision behind Polkadot and its experimental "canary network," Kusama. At the very heart of this vision lies a unique and innovative mechanism: the parachain auction.

For many in the cryptocurrency space, from beginners in Vietnam to seasoned global investors, the term "parachain auction" might sound complex. However, it represents one of the most exciting developments in blockchain technology today. It’s a system that determines which new projects get to connect to the Polkadot and Kusama networks, unlocking shared security, interoperability, and immense potential for innovation.

This guide will demystify parachain auctions. We will break down what they are, explain the crucial role of crowdloans, and explore how this process is shaping a multi-chain future. Whether you're looking to understand the fundamentals of next-generation blockchains or seeking new investment opportunities, this deep dive will equip you with the knowledge to navigate the world of Polkadot, Kusama, and their groundbreaking auction model.

What is Polkadot and Why Does it Need Parachains?

To understand parachain auctions, we must first grasp the architecture of Polkadot. Polkadot is not a typical blockchain; it's a "meta-protocol" or a "blockchain of blockchains." Its goal is to enable different, independent blockchains to communicate and transfer value in a secure, trust-free manner.

The core of Polkadot is the Relay Chain. This is the main blockchain responsible for the network's shared security, consensus, and interoperability. However, the Relay Chain itself doesn't support complex applications. Its primary job is to coordinate the system as a whole and secure its connected chains.

These connected chains are called parachains (short for "parallelized chains"). A parachain is a sovereign blockchain, often built for a specific purpose—it could be optimized for DeFi, gaming, digital identity, or supply chain management. By connecting to the Relay Chain, a parachain benefits from Polkadot's robust security model and can seamlessly interact with other parachains in the ecosystem.

However, the number of parachain slots on the Relay Chain is limited. This scarcity is by design; it ensures the network remains performant and secure. So, how does the network decide which projects get one of these valuable slots? This is where parachain auctions come in.

A parachain auction is a competitive process where blockchain projects bid for the right to lease a parachain slot on the Polkadot or Kusama Relay Chain. Instead of paying fees in a traditional sense, projects bid by locking up the network's native token—DOT for Polkadot and KSM for Kusama. The project that bids the most tokens wins the auction and gets to operate as a parachain for the duration of the lease period (up to 96 weeks on Polkadot).

Kusama: Polkadot's Wild Cousin

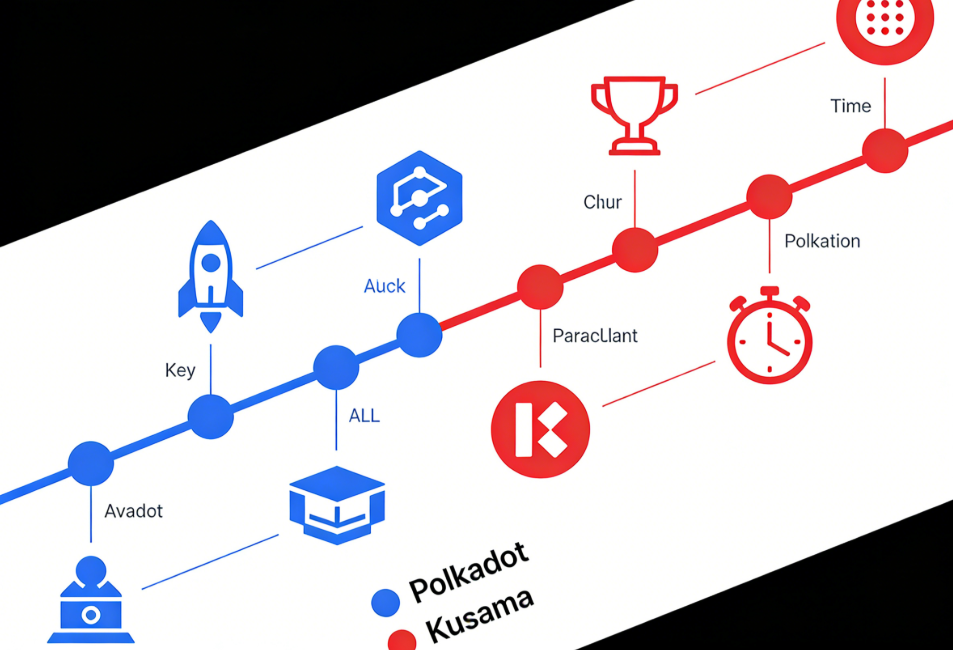

Before diving deeper into the mechanics, it's essential to introduce Kusama. Kusama is an independent blockchain network built with nearly the same codebase as Polkadot. It serves as a real-world testing ground for new technologies and projects before they are deployed on Polkadot.

Kusama is often called Polkadot's "canary network," a reference to the canaries that were once used in coal mines to detect dangerous gases. In the same way, Kusama provides an environment to test new features, parachains, and governance models in live economic conditions. This allows developers to identify potential issues and refine their applications before moving to the higher-stakes environment of Polkadot.

Kusama has its own parachain auctions, which function similarly to Polkadot's but with the network's native token, KSM. These auctions are typically faster-paced and have shorter lease periods, reflecting the network's experimental nature. Many successful Polkadot parachains, such as Moonbeam and Astar, first launched and won an auction on Kusama (as Moonriver and Shiden, respectively).

How Parachain Auctions Work: A Step-by-Step Breakdown

The parachain auction process is a unique blend of game theory and economic strategy. It uses a variation of a candle auction to ensure fairness and prevent last-minute bid sniping.

A traditional candle auction, dating back to the 16th century, would end when a candle flame extinguished itself. The winner was the highest bidder at that unpredictable moment. Polkadot’s digital version uses a random, retroactively determined end time.

Here’s how it unfolds:

- The Auction Period: An auction is open for a set period, typically around one week. During this time, projects can submit their bids.

- The Bidding Process: Projects bid DOT (on Polkadot) or KSM (on Kusama) to lease a parachain slot. These tokens are locked for the entire lease duration if the project wins.

- The Random Ending: The auction doesn’t end at a predefined time. Instead, it has an "opening period" followed by an "ending period." The exact moment the auction concludes is determined retroactively by a random number generated on-chain after the ending period is over.

- Determining the Winner: The system looks back to the randomly selected closing moment and identifies the project with the highest bid at that specific point in time. That project is declared the winner.

This mechanism encourages projects to bid their highest amount early and maintain it, as they don't know when the "candle will go out." It prevents the last-second bidding wars common in traditional auctions. To succeed in this environment, projects and their supporters need a clear strategy, which is often managed through reliable platforms like hibt.

The Power of the People: Understanding Crowdloans

Most projects don't have enough DOT or KSM tokens on their own to win a highly competitive parachain auction. This is where one of the most innovative aspects of the Polkadot ecosystem comes into play: crowdloans.

A crowdloan is a mechanism that allows a project to source or "crowdfund" the tokens needed for its auction bid directly from its community and supporters.

Here’s the process:

- A Project Starts a Crowdloan Campaign: The project team announces its intention to bid for a parachain slot and invites its community to contribute DOT or KSM to its campaign.

- Supporters Contribute Tokens: Individuals who believe in the project can lock their DOT or KSM in a special crowdloan module. These funds are held securely by the Relay Chain itself, not by the project team. This is a crucial security feature—the project team never takes custody of the contributed tokens.

- The Project Bids in the Auction: The project uses the total pool of contributed tokens as its bid in the parachain auction.

- Two Possible Outcomes:

- If the project wins the auction: The contributed DOT/KSM remains locked for the entire parachain lease period (e.g., 96 weeks). In return for their support, the project rewards its crowdloan participants with its own native tokens. This is often how new project tokens are distributed to their earliest supporters. At the end of the lease, the original DOT/KSM is automatically returned to the contributors.

- If the project loses the auction: The contributed DOT/KSM is returned to the contributors shortly after the crowdloan campaign ends.

The crowdloan model is a powerful win-win. Projects can secure a parachain slot without having to purchase a massive amount of tokens. Supporters get to back projects they believe in and earn new tokens as a reward, all while retaining ownership of their original DOT or KSM. It's a form of community-powered staking, where the opportunity cost of locking up tokens is rewarded with early access to a new project's ecosystem. For anyone managing a diverse portfolio, understanding these unique staking-like opportunities is vital, and a platform like https://hibt.com can be an essential tool.

Real-World Examples: Landmark Parachain Auctions

The theoretical concepts of parachain auctions and crowdloans come to life when we look at the projects that have successfully used this model to launch.

Case Study 1: Moonbeam on Polkadot

Moonbeam is an Ethereum-compatible smart contract platform on Polkadot. Its goal is to make it easy for developers to deploy their existing Ethereum dApps on Polkadot with minimal changes. This allows them to benefit from Polkadot's scalability and interoperability while accessing users and assets from the broader Polkadot ecosystem.

- The Crowdloan: Moonbeam's crowdloan for a Polkadot parachain slot was one of the most anticipated events in the ecosystem. It attracted over 200,000 contributors who collectively locked more than 35 million DOT (valued at over $1.4 billion at the time).

- The Reward: In exchange for their support, contributors were rewarded with Moonbeam's native token, GLMR. This massive community support demonstrated the huge demand for an EVM-compatible solution within Polkadot.

- The Impact: After winning its slot, Moonbeam quickly became a major hub of activity on Polkadot. Numerous Ethereum-based projects, including DeFi protocols like Sushi and Curve, deployed on the network, bringing liquidity and users with them.

Case Study 2: Acala on Polkadot

Acala is positioned as the all-in-one DeFi hub of Polkadot. It offers a suite of financial applications, including a decentralized stablecoin (aUSD), a liquid staking protocol (allowing users to stake their DOT while still using it in DeFi), and a decentralized exchange (DEX).

- The Crowdloan: Acala also ran an incredibly successful crowdloan campaign, raising over 32 million DOT from more than 81,000 contributors.

- The Reward: Participants were rewarded with Acala's native token, ACA. The strong community backing solidified Acala's position as a foundational DeFi building block for the Polkadot ecosystem.

- The Impact: By winning one of the first parachain slots, Acala was able to establish itself as a core component of Polkadot's DeFi landscape. Its stablecoin, aUSD, was designed to be the default stablecoin for the entire multi-chain ecosystem, facilitating transactions and commerce across different parachains.

Case Study 3: Karura on Kusama

Karura is Acala's sister network on Kusama. It offers the same suite of DeFi products but in the faster, more experimental environment of Kusama. It serves as a proving ground for new features before they are rolled out on Acala.

- The Crowdloan: Karura won the very first parachain auction on Kusama, a landmark event for the entire ecosystem. It raised over 500,000 KSM from more than 20,000 supporters.

- The Reward: Contributors received Karura's native token, KAR. Winning the first slot gave the project significant first-mover advantage and media attention.

- The Impact: Karura quickly became a center for DeFi activity on Kusama. It demonstrated the viability of the parachain auction and crowdloan model and paved the way for dozens of other projects to follow. This success highlighted the importance of a "canary network" for battle-testing applications in a live environment. Navigating these fast-moving opportunities requires agility and access to the right trading tools, which is why many investors rely on hibt.

Benefits and Drawbacks of the Parachain Auction Model

The parachain auction and crowdloan system is a novel approach to network growth and security, but it has its own set of trade-offs.

Benefits

- Shared Security: Winning projects plug into the Polkadot/Kusama Relay Chain and immediately benefit from its high level of economic security. They don't need to bootstrap their own set of validators, which is a costly and time-consuming process.

- Fair and Transparent Access: The auction mechanism is an open and permissionless way to allocate scarce network resources. Any project can bid for a slot.

- Strong Community Alignment: The crowdloan model ensures that projects which win a slot have strong, demonstrated community support. It aligns the incentives of the project team with its users from day one.

- Effective Token Distribution: Crowdloans serve as a powerful mechanism for distributing a project's native tokens to a wide and committed user base, avoiding concentration in the hands of a few large venture capitalists.

- Economic Efficiency: Instead of projects spending capital to pay for security, they lock up capital (DOT/KSM), which is returned later. This is a more economically efficient model for the ecosystem as a whole.

Drawbacks

- High Barrier to Entry: The amount of DOT or KSM required to win an auction is substantial, creating a high barrier to entry for smaller or newer teams, even with crowdloans.

- Opportunity Cost for Contributors: While contributors get their original tokens back, those tokens are locked for up to two years. During that time, they cannot stake them for regular staking rewards or sell them, representing a significant opportunity cost.

- Market-Dependent Rewards: The value of the reward tokens received by crowdloan participants is subject to market volatility. There is no guarantee that the rewards will outperform the potential staking yield of the locked DOT or KSM.

- Complexity for Beginners: The entire process—understanding auctions, evaluating projects, and participating in crowdloans—can be daunting for newcomers to the crypto space.

The Future of Interoperability is Auctioned

Parachain auctions are more than just a clever technical mechanism; they represent a fundamental shift in how blockchain networks are built and how they evolve. Instead of isolated, competing networks, Polkadot and Kusama are fostering a collaborative ecosystem where hundreds of specialized blockchains can work together, secured by a single, robust Relay Chain.

This model enables a future where a user could play a game on one parachain, use an in-game asset as collateral in a DeFi protocol on a second parachain, and use a decentralized identity from a third parachain to verify their actions, all seamlessly and without friction.

For investors and users in Vietnam and around the world, parachain auctions offer a unique opportunity to become part of this future. By participating in crowdloans, individuals can play a direct role in deciding which projects join the ecosystem and become early stakeholders in the next generation of decentralized applications. It is a dynamic and evolving field that requires continuous learning and a reliable platform to manage assets and explore opportunities.

As the multi-chain world continues to grow, understanding mechanisms like parachain auctions will be essential. They are the gateway to one of the most vibrant and innovative ecosystems in the blockchain space. With the right knowledge and tools, anyone can participate in this exciting new chapter of decentralized technology. To start your journey and explore the assets powering this new wave of innovation, consider a versatile platform like HIBT.

About the Author

Dr. Ivan Volkov is a distinguished expert in distributed systems and cryptoeconomics. He has authored 12 peer-reviewed papers focusing on auction theory and cross-chain communication protocols. Dr. Volkov has played a pivotal role in the blockchain industry, leading the security and economic audits for several high-profile Layer-1 and DeFi projects, helping to secure billions in user funds. His research is dedicated to designing fair, secure, and scalable mechanisms for decentralized network growth.