The digital world is undergoing a massive transformation, moving from the user-generated content era of Web 2.0 to the decentralized, user-owned internet of Web 3.0. This new chapter is built on blockchain technology, the same foundation that powers cryptocurrencies like Bitcoin and Ethereum. For individuals in Vietnam, from cryptocurrency beginners to seasoned investors, this shift presents a golden opportunity. Understanding Web 3.0 business ideas is no longer just for tech entrepreneurs; it is essential for anyone looking to achieve success in the cryptocurrency space.

This guide will walk you through how to identify and leverage promising Web 3.0 business ideas to enhance your crypto investment strategy. We will explore the core concepts of Web 3.0, identify lucrative opportunities within the Vietnamese market, and provide actionable steps to get started. By the end, you will have a clear roadmap for navigating this exciting new frontier and positioning yourself for growth.

What is Web 3.0 and Why Does It Matter for Crypto Investors?

Before diving into specific business ideas, it’s crucial to understand what Web 3.0 is. In simple terms, Web 3.0 represents the next evolution of the internet, one that is decentralized, transparent, and user-centric. Unlike Web 2.0, where large corporations control data and platforms, Web 3.0 gives ownership back to the users through blockchain technology.

Key characteristics of Web 3.0 include:

- Decentralization: Instead of relying on central servers, Web 3.0 applications run on peer-to-peer networks (blockchains). This eliminates single points of failure and censorship.

- Trustless and Permissionless: Transactions and interactions are verified by the network, not a central authority. Anyone can participate without needing approval.

- Artificial Intelligence (AI) and Machine Learning (ML): Web 3.0 integrates AI to provide smarter, more personalized user experiences.

- Connectivity and Ubiquity: The internet will be accessible everywhere, on any device, moving beyond the computers and smartphones we use today.

For cryptocurrency investors, Web 3.0 is the engine driving the entire ecosystem. Cryptocurrencies are the native assets of this new internet, used to power decentralized applications (dApps), facilitate transactions, and govern communities. As Web 3.0 grows, so will the utility and value of the cryptocurrencies that underpin it. By investing in Web 3.0 projects, you are not just buying a digital asset; you are buying a stake in the future of the internet.

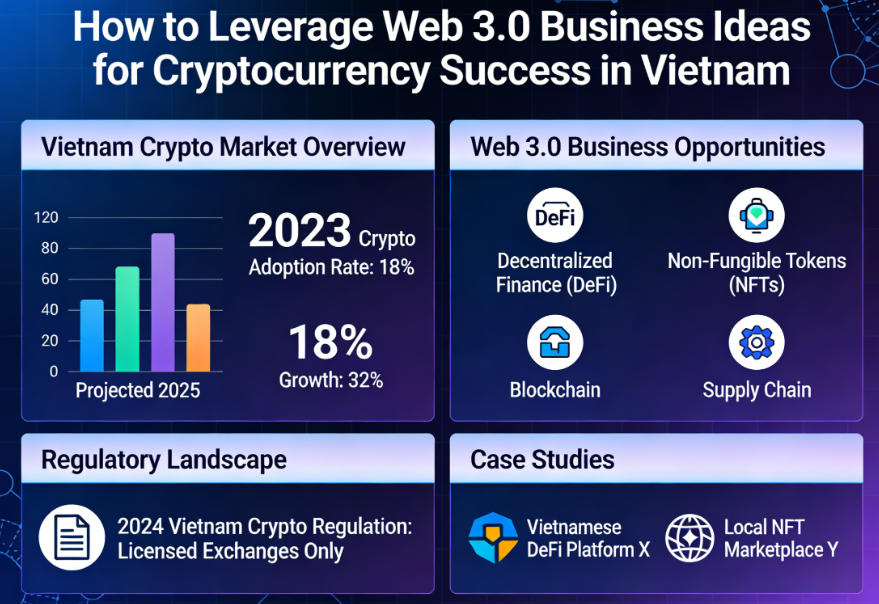

Identifying Promising Web 3.0 Sectors in Vietnam

The Vietnamese market has shown a remarkable aptitude for adopting new technologies, and cryptocurrency is no exception. With a young, tech-savvy population, the country is a fertile ground for blockchain innovation. Investors should pay close attention to several key sectors where Web 3.0 is poised to make a significant impact.

1. Decentralized Finance (DeFi)

Decentralized Finance, or DeFi, aims to recreate traditional financial systems like lending, borrowing, and trading on the blockchain. This removes the need for banks and other intermediaries, offering a more open and accessible financial system. For investors, DeFi presents opportunities to earn passive income through staking, liquidity provision, and yield farming.

- Staking: By locking up your cryptocurrency in a DeFi protocol, you help secure the network and earn rewards in return. It’s similar to earning interest in a savings account.

- Liquidity Provision: DeFi exchanges, known as Automated Market Makers (AMMs), rely on user-supplied liquidity pools. By contributing your assets to these pools, you earn a share of the trading fees.

- Yield Farming: This is a more advanced strategy where users move their assets between different DeFi protocols to maximize their returns.

Vietnam-Specific Opportunity: As more Vietnamese look for alternatives to traditional banking, DeFi platforms that offer user-friendly interfaces and services tailored to the local market can see significant adoption. Projects focused on micro-lending or cross-border remittances have immense potential.

2. GameFi and the Metaverse

GameFi, the intersection of gaming and finance, has exploded in popularity, particularly in Southeast Asia. These "play-to-earn" (P2E) games allow players to earn real cryptocurrency and non-fungible tokens (NFTs) that they truly own. The Metaverse, a collective virtual shared space, is the ultimate destination for these experiences.

Case Study: Axie Infinity

Axie Infinity, a game with strong roots in Vietnam, is a prime example of GameFi's power. At its peak, the game allowed thousands of players in the Philippines and Vietnam to earn a substantial income by playing the game. Players could breed, battle, and trade digital creatures called Axies, which are NFTs. This case demonstrates the potential for blockchain games to create real economic opportunities and showcases the high demand for such projects in the region.

How to Leverage This:

Investors can look for new GameFi projects with strong tokenomics (the economics of the crypto token), engaging gameplay, and a clear roadmap. Investing in the project's native token or its in-game NFTs can yield significant returns if the game gains traction. Platforms like hibt often list promising GameFi tokens, providing an accessible entry point for investors.

3. Non-Fungible Tokens (NFTs) and Digital Collectibles

NFTs are unique digital assets that represent ownership of an item, such as art, music, or a virtual piece of land. They have created new markets for artists and creators, allowing them to monetize their work directly without intermediaries. For investors, NFTs can be a high-risk, high-reward asset class.

Vietnam's Creative Potential: Vietnam has a rich cultural heritage and a thriving community of digital artists. NFT marketplaces that focus on showcasing and promoting local talent can tap into this creative pool. Think of digital versions of traditional lacquer paintings or modern art inspired by Vietnamese folklore. These culturally significant NFTs can attract both local and international collectors.

Investment Strategy: Instead of just speculating on popular collections, consider NFTs with real utility. For example, an NFT might grant you access to an exclusive event, a membership in a club, or special perks in a Metaverse.

4. Decentralized Autonomous Organizations (DAOs)

A DAO is an organization represented by rules encoded as a computer program that is transparent, controlled by the organization members, and not influenced by a central government. Think of it as an internet-native co-op. Decisions are made by members who hold the DAO's governance tokens.

How to Participate:

You can become part of a DAO by purchasing its governance tokens. This gives you the right to vote on proposals and influence the direction of the project. There are DAOs for everything from managing DeFi protocols to funding art projects and venture capital investments. For crypto investors, participating in a DAO provides direct insight into a project's operations and a say in its future success.

A Step-by-Step Guide to Investing in Web 3.0 Ideas

Now that you understand the key sectors, here is a practical, step-by-step guide to help you start leveraging Web 3.0 business ideas for cryptocurrency success.

Step 1: Educate Yourself Continuously

The Web 3.0 space evolves at a breakneck pace. What is revolutionary today might be obsolete tomorrow. As an investor, your greatest asset is knowledge.

- Follow Key Opinion Leaders: Follow respected developers, analysts, and investors on platforms like X (formerly Twitter) and YouTube.

- Read Whitepapers: Before investing in any project, read its whitepaper. This document outlines the project's goals, technology, tokenomics, and roadmap. It’s your best source for understanding the project's fundamentals.

- Join Communities: Engage with communities on platforms like Discord and Telegram. This is where you can interact directly with the development team and other investors.

Step 2: Choose a Secure and Reliable Exchange

Your journey into Web 3.0 investing begins with a secure platform to buy, sell, and manage your cryptocurrencies. For investors in Vietnam, choosing an exchange that understands the local market is a significant advantage. A good exchange should offer:

- Robust Security: Look for features like two-factor authentication (2FA), cold storage for assets, and a history of protecting user funds.

- Wide Range of Assets: The platform should list a diverse selection of cryptocurrencies, including established coins like BTC and ETH, as well as promising new Web 3.0 tokens.

- User-Friendly Interface: Whether you are a beginner or an expert, the platform should be easy to navigate.

- Localized Support: Access to customer support in Vietnamese can be invaluable when you need assistance.

Platforms that provide comprehensive trading services, from spot trading to futures, can serve as your central hub for all crypto activities. Explore your options on a trusted platform like https://hibt.com to get started.

Step 3: Develop a Diversified Investment Thesis

Do not put all your eggs in one basket. The world of Web 3.0 is vast, and diversification is key to managing risk. Your portfolio should reflect a clear investment thesis.

- Core Holdings (50-60%): A significant portion of your portfolio should be in established cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH). These are the pillars of the crypto economy and are generally considered safer long-term investments.

- Mid-Cap Growth (20-30%): Allocate a portion to promising projects in high-growth sectors like DeFi, GameFi, or Layer-2 scaling solutions. These are projects that have established a product but still have significant room to grow.

- Speculative Bets (10-20%): This is where you can invest a small amount in new, high-risk, high-reward projects. This could be a new GameFi token, an NFT collection, or a micro-cap DAO. Only invest what you are willing to lose in this category.

Step 4: Conduct Thorough Due Diligence (DYOR)

"Do Your Own Research" (DYOR) is a mantra in the crypto world for a reason. Before investing, you must vet each project carefully. Here is a checklist for your research:

- The Team: Who are the founders and developers? Do they have a proven track record? Are they transparent and active in the community?

- The Technology: What problem does the project solve? Is the technology genuinely innovative, or is it just a copy of another project?

- Tokenomics: How is the token distributed? Is there a fixed supply? What is its utility within the ecosystem? Be wary of projects with a high inflation rate or where the team holds a large percentage of the tokens.

- The Community: A strong, active community is often a sign of a healthy project. Look for genuine engagement, not just hype.

- Roadmap and Progress: Does the project have a clear roadmap? Are they meeting their development milestones?

Step 5: Start Small and Scale Your Investments

If you are a crypto beginner, it is wise to start with a small investment. Use this initial amount to familiarize yourself with the process of buying, selling, and securing your assets. As you gain more confidence and knowledge, you can gradually increase your investment amount.

For example, you could start by purchasing a small amount of a well-known GameFi token or a DeFi governance token. Track its performance, participate in its community, and learn how the project operates. This hands-on experience is invaluable and will prepare you for making larger, more informed investment decisions in the future.

Step 6: Secure Your Assets

Once you start accumulating cryptocurrency, security becomes paramount. While keeping your assets on a trusted exchange is convenient for trading, you should consider moving your long-term holdings to a personal wallet for maximum security.

- Hot Wallets: These are software wallets connected to the internet (e.g., MetaMask, Trust Wallet). They are convenient for daily transactions but are more vulnerable to hacking.

- Cold Wallets: These are hardware wallets (e.g., Ledger, Trezor) that store your private keys offline. They offer the highest level of security for your long-term investments.

Remember the golden rule of crypto: "Not your keys, not your coins." If you do not control your private keys, you do not truly own your assets.

The Future of Web 3.0 and Crypto in Vietnam

The Vietnamese government and population are increasingly recognizing the potential of blockchain technology. With clear regulatory frameworks on the horizon and a booming digital economy, Vietnam is well-positioned to become a leader in the Web 3.0 space. For investors, this presents a unique window of opportunity.

By focusing on emerging sectors like DeFi, GameFi, and NFTs, and by following a disciplined investment strategy, you can capitalize on the growth of the decentralized internet. The journey requires continuous learning, careful research, and a long-term perspective. The ideas discussed here, from decentralized finance innovations to blockchain innovation for investors, are just the beginning.

The fusion of Web 3.0 business ideas for crypto beginners and seasoned traders will define the next wave of financial success. Whether you are exploring Vietnam cryptocurrency market opportunities for the first time or looking to deepen your existing portfolio, the principles remain the same: educate yourself, start with a secure platform, diversify your assets, and always prioritize security.

The tools and platforms to begin this journey are more accessible than ever. With a commitment to learning and a strategic approach, you can harness the power of Web 3.0 to achieve your financial goals. Get started on your Web 3.0 investment journey today with HIBT.

About the Author

Dr. Minh Pham is a leading authority in distributed systems and cryptographic security. He has authored over 20 peer-reviewed papers on blockchain consensus mechanisms and zero-knowledge proofs. Dr. Pham has also led security audits for several globally recognized blockchain projects, helping to secure billions of dollars in digital assets. He is a passionate advocate for financial decentralization and its potential to empower individuals worldwide.