Lava Protocol is an innovative blockchain platform designed to facilitate the development and operation of decentralized applications by offering API subscription plans. This article will take an in-depth look at the economics of the Lava protocol, its token supply, and its unique deflation mechanism.

Lava Token Supply and Deflation Mechanism

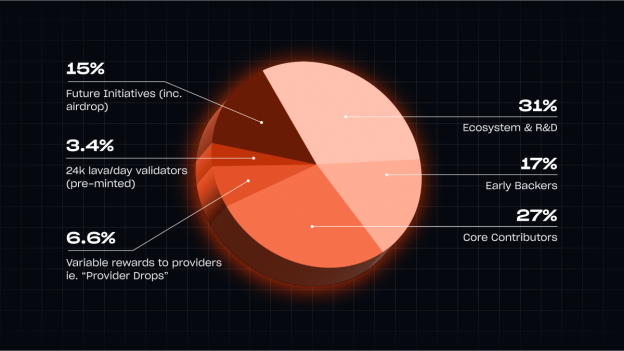

Token supply: The native token of the Lava protocol is LAVA, and the total supply is 1 billion (1,000,000,000) LAVA. Each LAVA can be divided into 1 uLAVA, that is, 1 LAVA is equal to 10^-6 uLAVA.

Deflation Mechanism: The Lava protocol adopts a novel deflation mechanism to attract providers, especially in the early stages of the mainnet. 6.6% of the token supply is allocated to Provider Drops, a monthly distributed reward mechanism used to initiate provider participation.

As the network attracts more consumers, the need for Drops will decrease because providers will get the difference from subscription payments. In addition, as the staked LAVA percentage increases, validator rewards will decrease, a linear reduction mechanism, and when staking reaches 80%, the rewards and half of the subscription fee tax will be destroyed, further controlling the inflation of the token.

At the end of each month, any unallocated validator rewards will be burned, which aligns validator interests with the stability and efficiency of the network.

Economic Actors and Key Terms

Consumer: Consumers purchase LAVA subscription plans on-chain to access the diverse API specifications provided by the Lava protocol. Subscription plans are priced by governance, offer limited compute units, and vary based on their specifications.

Providers: Providers stake tokens on individual specifications to ensure the integrity of their services. To accept delegation from others, a minimum direct pledge is required. Requests are routed to providers via a stake-weighted mechanism.

Validators: Validators stake LAVA to ensure the security of the network. They create blocks, execute transactions, and vote on blocks created by other validators.

Token holders

Token holders can choose to stake their tokens to validators, re-stake to providers, and participate in on-chain governance.

Champion: Champions create, develop, and maintain RPC and API specifications and software, and receive rewards. They can also contribute to the community by completing bounties.

Chain: The chain deposits token incentives into Lava, and the reward provider provides specifications for its developers and users. Provider and verifier can be different entities.

The role of Lava tokens

LAVA tokens play multiple roles within the Lava protocol:

Transaction Fees: LAVA is an asset unit for the gas fee required to perform transactions or other operations on the Lava protocol.

Network Security: Validators stake LAVA to ensure the security of the network and participate in governance.

Service Quality: Providers stake LAVA, affecting how often they are paired with consumers.

Delegation and re-staking: Token holders can delegate their LAVA to validators or re-stake to providers.

Rewards and re-staking

The Lava protocol incentivizes participants through a variety of reward mechanisms:

Provider Rewards: 6.6% of the LAVA supply is allocated to Provider Rewards, a monthly distributed reward mechanism used to initiate provider participation.

Burning Mechanism: As the staked LAVA percentage increases, validator rewards will decrease, and when staking reaches 80%, the rewards and half of the subscription fee tax will be burned.

Unallocated Reward Burning: At the end of each month, any unallocated validator rewards will be burned, which aligns validator interests with the stability and efficiency of the network.

in conclusion

The Lava protocol provides a powerful platform for the development and operation of decentralized applications through its unique economic mechanism and token supply strategy. Its deflation mechanism, provider rewards, and diverse participant roles make the Lava protocol stand out in the blockchain space. As more consumers and providers join, the Lava protocol is expected to become an important player in the decentralized application ecosystem.